Derivative risks

Risks are not unique to derivative instruments alone, but they need to be viewed as part of the overall derivative strategy. Some of the major derivative risks are:

Market risk

- The risk to earnings from adverse market price movements

Operational risk

- The risk of losses occurring as a result of inadequate systems and control, human error, or management failure

Counter party credit risk

- The risk that a party to a derivative contract will fail to perform its obligation

Legal risk

- The risk of loss because a contract is found legally unenforceable.

Derivative risk management process

One can manage these basic derivative risks by following steps

Step 1

Understand the purpose of using the derivative uses (trading, hedging, or funding)

Step 2

Recognize a leveraged derivative can magnify the contract’s price fluctuations

Step 3

Understand a derivative instrument’s risk in worst case scenarios

Step 4

Establish a loss strategy and stick with it.

Need for best practices Framework

Derivative instruments facilitate risk sharing, risk shifting or hedging. They also enable one in the process of price discovery. At the same time, they also land one in new risks that are potentially capable of destabilizing even matured and successful businesses and some times even matured economies. Some of these risks are potently negative and their consequences are very grave.

Basically these consequences arise from mainly from the ‘abuse’ or ‘misuse’ of the derivative instruments through fraud, manipulation, tax evasion or avoidance and distortion of information which is vital for the market efficiency. Some others pertain to the negative consequences from trading.

Inappropriate and undisciplined derivative instruments can result in the creation of new risks in the form of greater levels of market risk for a given amount of capital in the financial system and in higher degrees of financial sector vulnerability. They pose a very serious challenge to the safety and soundness of financial markets.

They therefore warrant immediate regulatory remedy. As we all know, self regulation is the best regulation. Starting point for such self regulation is prescription and practice of best practices.

Best practices Framework

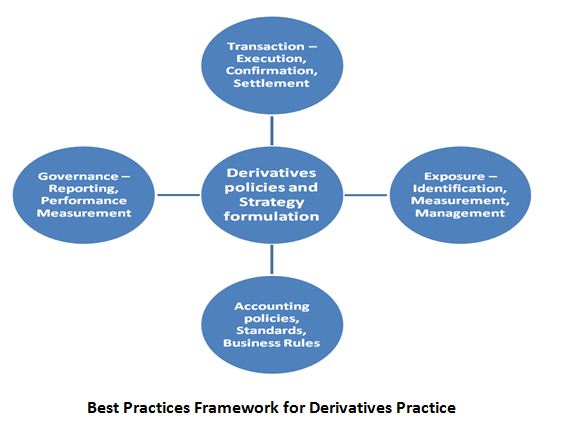

Going by the market experience and practice, we have identified certain critical best practices in our suggested framework for derivatives practice.

Best Practices Framework for Derivatives Practice

Ideally any best practices frame work should facilitate the business to answer critical questions in the conduct of derivative practice.

Some critical questions in derivatives practice are:

- Are there written policy guidelines describing the objectives and scope for the use of derivative instruments?

- What type / kind of specific derivative products and strategies are permitted?

- Any outer limits prescribed for taking up these derivative transactions?

- Are these guidelines consistent with the overall strategy and do they conform to the types of operations?

- Does the Board of Directors or other relevant oversight groups understand what risks are being assumed?

- Whether these authorizations for derivative transactions have been unambiguously documented?

- Are there mechanisms to spot deviations? Whether these mechanisms are independent and sophisticated?

- Whether a senior manager’s approval is necessary for binding the business organization to a derivative transaction?

- Are there independent supervisory personnel responsible for developing, executing and derivative strategies and transactions?

- Are there counter checks (maker-checker concept) for derivative transactions taken up? How soon they are counter checked?

- Is there a methodology in place for measuring market risk? (value at risk, stress testing, horizon analysis)

- Are there written limits on how much market risk can be assumed at any point of time?

- What are the liquidity implications?

- Is there any active secondary market for the derivative transaction?

- How wide is the bid ask spread?

- Are there prescribed limits for credit risk?

- Is there an approved list of acceptable counterparties with sub limits?

- Are there separate credit limits in place for derivative transactions?

- Are there agreements or contracts in place to document and govern derivative transactions?

- Are these agreements in ISDA format and legally enforceable?

- Whether netting and settlement procedures are adequately covered in these agreements?

- What are the accounting policies for derivative transactions?

- What are the prescriptions for periodical revaluation of derivative transactions?

- What are the disclosure norms for derivative transactions?

- What are the capital implications for derivative transactions?

- What are the reporting mechanisms?

What could be the fall out for not opting for them?

The benefits of having such a best practices framework for derivatives practice can be highlighted by looking at what happened to some leading names in the market place for not having such a framework in the first place or not observing them scrupulously if they had one.

|

Organization |

Area of derivative |

Amount of loss |

| Baring Bank | Options |

US$ 1,240 million |

| LTCM | Currency, I.R Derivatives |

US$ 4,000 million |

| Metalgesellschaft | Energy derivatives |

US$ 1,340 million |

| Orange County | Structured notes, Reverse REPO |

US$ 2,000 million |

| SocGen | Equity derivatives |

US$ 7,100 million |

The causes for these losses were varied from lack of supervision to failure of pricing models applied. Apparently most of the cases related to market manipulation have their origin in inadequate internal controls at the business level. The existence of internal controls, procedures and systems to ensure ongoing compliance with established rules and regulations could have ensured against them.

In this regard, the best practices framework for derivatives practice suggested above is ideal for any type of market – orderly or turbulent.