Setting:

According to Chris Skinner “There’s plenty of innovation in banking right now, from investment through commercial to retail banking. ………… But some innovators create new business models at the expense of the incumbents – that’s the way it is supposed to be, isn’t it?” Now is the time for the stock exchanges to strategically finovate to remain in business.

Pain:

London Stock Exchange (LSE) continues to face difficulties with drop in profits when the market has almost doubled in value in recent months. Such reduction in business volumes and drop in profits is the case with other established stock exchanges as well. Electronic trading through multilateral trading facility makes things difficult for established exchanges by taking away major chunk of the growing business volumes.

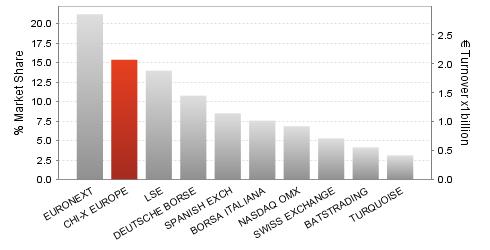

To get to know firsthand how big this onslaught is, let us look at the Top 10 European Trading Venues – Market share and Turnover as on Tuesday Dec 29 2009.

Solution:

Surely if this is allowed to go on, in the near foreseeable future, the established stock exchanges will become mere monuments in the investors’/traders’ world. It is now time to act for stock exchanges. They will need to refurbish their image and strategically finovate to keep pace with these changing, challenging times. Are there any readymade packages on offer?

Some out of the box strategic solutions could include

a. Review and revamp existing technologies with a view to provide fully automated, anonymous, price/time/cost priority environment with access through well established communication protocols.

b. Slash the trading costs and the clearing costs to match with the lowest of the costs offered by such multilateral trading facilities. The resultant growing business volumes would make up for the loss in revenues!

c. Forge a strong alliance with all established stock exchanges in the world with an aim to provide real time ‘connect’ facilities to the trading participants to transact in other stock exchanges through the local stock exchange, cutting across geographies, countries and currencies.

d. Simultaneously provide an environment to facilitate listing of securities in more than one stock exchange and in more than one currency to enable participants to trade in the stock exchange and in the currency of their choice – providing truly real time arbitraging opportunities as well!

e. The strong alliance of the stock exchanges to provide a genuine ‘real time’ cross margining facilities to the investors which may include the facility to convert the margin money in one currency into another at genuinely ‘market’ exchange rates at cost. This may need setting up of a fully automated Exchange Bank well connected with global foreign exchange markets!

f. In a similar manner create a ‘super’ ‘global’ central counterparty by forging an alliance between different central counter parties – to provide absolutely ‘risk’ free clearing and settlement to the participants.

The above ‘sample’ suggestions will help the stock exchanges to offer trading participants wider choice, improved liquidity, ultra low, execution, clearing and settlement costs at ‘nil’ risk.

Well. These things are possible only when the stock exchanges are willing to embrace financial technology, as such financial technology alone can provide the ideal setting for strategic finovation.