Securities Lending is an OTC market business practice that involves borrowing and lending of securities mainly for the purpose of covering short-sale positions. Sometimes, it is also be used for derivative hedges and dividend arbitrage across tax jurisdictions. Basically it is the practice where an institution with a portfolio of investment securities lends out for a short term, on a collateralized basis, some of its portfolio securities that would otherwise be sitting idle. In the United States, securities loans are typically made in exchange for cash collateral.

Securities lending has been in existence since at least the 19th century. In the 1970s, securities lending increased in the U.S. as custodial banks lent out the portfolio securities of their custodial clients, and registered investment companies began lending their securities. In the 1990s and early 2000s, with the expansion of the global securities markets and investing, and the exponential increase in short selling and related strategies, the demand for securities lending also grew.

The markets viewed securities lending as a relatively low risk venture till recently, but the recent credit crisis proved otherwise – that it can be anything but low risk. Cash collateral reinvestment programs experienced unanticipated illiquidity and losses. Institutions that lent their securities, and the beneficiaries relying on those institutions, were significantly harmed.

As a result, many questions have arisen with respect to the securities lending market and whether it may be improved for the benefit of market participants and investors. Regulators are having a fresh look at this business as a whole and coming out with prescriptions and proscriptions.

This paper makes an attempt to look at this business to identify its various dimensions, extant limitations placed by the applications that are supposed to enable this business, expectations of the player-participants of the market place, risks and their management and changing regulatory approaches.

DIMENSIONS:

Securities lending transactions have become, and will remain, an important element of modern financial markets. Securities lending involves the temporary exchange of securities, generally for cash or other securities of at least an equivalent value, with an obligation to redeliver a like quantity of the same securities on a future date.

Securities lending transactions are typically structured as under:

– Securities loan transactions

– Repurchase agreements

– Sell buy back arrangements

The economics of the transactions are the same though the structure of the transactions differs. The key to the business success lies in understanding the typical functional components.

A typical Securities Lending business functional model will have the following components

|

Contract |

Inventory Management |

Collateral Processing |

Limit Monitoring |

Cash Management |

Billing

|

||

| Data Management | Communication | Connectivity | Risk Management | ||||

A similar componentized model for synthetics will look like

|

Drivers |

Composition |

Underlying |

Dimensions |

|

Trade Related |

Cash Flow Related |

Pricing and Process |

Purpose |

A further sub-componentized model for the synthetics strategies is captured below

INTRODUCTION:

This way of capturing functional components of any business is the first and best way to address and achieve sure success.

It would be better if securities driven securities lending transactions are distinguished from cash driven securities lending transactions. In “securities-driven” transactions, institutions seek to lend/borrow specific securities against collateral, while in “cash-driven” transactions, institutions seek to lend/borrow securities as collateral in cash financing arrangements. The participants in the securities lending market place include securities borrowers and lenders, cash investors and borrowers, intermediaries and providers of clearing and settlement services.

LIMITATIONS:

Importance of customer experience in an ever changing and challenging financial environment is critical in security lending and borrowing business. Since this environment is constantly changing there is always a constant felt need at the customer experience end. This limitation comes in the way of the business.

While securities lending business has flourished within existing securities settlement systems, features unique to securities lending transactions have limitations and therefore implications for the market infrastructure.

In order to further promote liquid securities lending markets, the market infrastructure providers will need to include and consider automating trade processing functions, such as trade comparison, to reduce operational risks existent in manually intensive procedures, consider developing centralized facilities that provide for services such as central counterparty clearing, multilateral netting and tri-party lending and consider developing automated systems that identify and track securities lending transactions separately from ordinary market transactions. We believe, as of now, such facilities have not been implemented completely and comprehensively.

If we could address adequately the role of securities lending in the overall financial markets harmonization, implications of securities lending for market participants, implications of securities lending for market infrastructure, including securities settlement systems and implications of securities lending for market authorities including central banks and securities regulations, we could claim we have overcome the limitations of the market place. This appears to be a tall and challenging task.

Financial institution’s four broad strategies

– Reengineer internally

– Partner with a technology vendor

– Offer private label services in partnership with a vendor

– Relinquish control of technology and operations

– Factors Influencing the Growth or Contraction of Securities Lending

–

– Securities lending is principally demand driven. Therefore, contraction or growth of securities lending will be influenced directly by the volume of trading that has a short sale component. There is a fundamental misunderstanding regarding the transactions that drive demand, with an impression that directional short selling is either the only, or the principle, source of demand. While directional short selling is a factor, much of the demand for borrowing results from short selling related to a whole host of other trading strategies including:

–

– Convertible arbitrage

– Warrant arbitrage

– Risk arbitrage

– Options trading

– Long/short strategies

– Since these trading strategies are largely undertaken by hedge funds, the borrowing marketplace will only be as robust as the hedge funds that generate demand and their gross short exposures. This is the primary factor that will influence the growth or contraction of securities lending. Borrow balances today are lower than they were a year ago and significantly below their highs. This is directly related to the changes in hedge fund behavior in the wake of the financial crisis.

–

– A second factor that can impact the size of the securities lending market is the depth and breadth of supply. Given that much of the demand for securities lending is for hedging, the interaction between supply and demand as reflected in borrowing fees, can influence whether a trading strategy will work. To the extent that supply tightens, rates could make certain trades uneconomic. Regulatory or other factors that would make it undesirable for institutions to lend would therefore affect the size of the market. While the supply side of the market experienced some turbulence during the financial crisis, institutions largely remained in the market. Some of the institutions that did curtail their lending activity have returned and others are expected to return as markets improve.

–

– A third factor that has the ability to impact the size of the securities lending market is unpredictable regulatory action. This was the case last summer in the wake of emergency orders which first required preborrows for 19 financial stocks and then prevented short selling altogether in the shares of financial companies. These orders contributed to short covering, but not to stability, as the “rules of the road” changed quickly and unpredictably.

EXPECTATIONS:

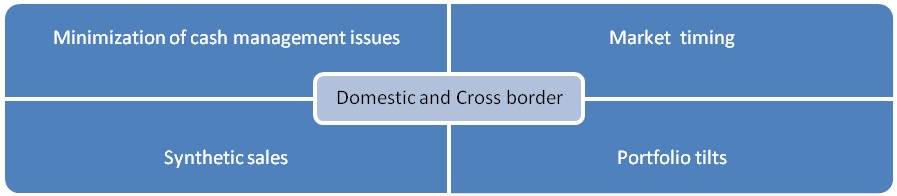

Global Capital Markets looks for platforms that provide multi product, multi broker access to pools of liquidity and capabilities such as modeling as well as algorithmic trading. This applies to our securities lending business as well.

Facilities like common platform for handling principal lending and agency lending, meeting squarely all the agency lending disclosure requirements, integrated collateral management including derivatives collateral management, integration of analytics in the applications facilitating front office traders and monitoring potential abuses associated with the securities lending market are always in the wish list of the market participants.

Enhanced collateral flexibility, introduction of competitive pricing, broader spread of counterparty expertise to minimize counter party exposures, maintaining accurate books and records, and timely payment of billing and dividends/coupons are some of the measures that will lead to efficiency improvement and cost reduction. In this business, improvements in integration and consolidation will help operational optimization.

Like in any other business, technology is the key driver to success in securities lending business. Limitations in technology that constrain strategies and workflows affect very badly securities lending business development. Securities lending is longing for a technology that supports new business models with accurate, consistent information at the core level such as legal and regulatory underpinnings, accounting and capital treatment, settlement arrangements and risk management.

Improving securities lending business for the benefit of investors will need to be addressed from the point of view of transparency, electronic platforms, central counterparties and accountability.

Transparent price determination of illiquid securities to arrive at mark to market values and complying with Agency Lending Disclosure Requirements to ensure transparent counterparty exposures are to be dealt with top most priority, particularly after the recent crises in financial markets. To ensure that transactions are settled quickly and with least operational disruption and to handle growing size and volumes in this market, we need well developed electronic platforms that can claim to meet varying needs of the market place and the participants. We need not highlight here that these platforms should facilitate straight through processing to both clients and investors and also facilitate proprietary securities lending transactions.

Establishment of a robust central counterparty infrastructure would require – streamlining operations to reduce risk, to interact on bilateral basis to negotiate hard to borrow transactions, isolating recall risk and loss due to a counterparty failure, and appropriate technology to connect with the above modern electronic platforms.

TRENDS AND CHALLENGES:

The recent financial crises have raised concerns about securities, market stability and systemic risk.

Security is an asset or third party commitment accepted by the security taker to secure an obligation of the security provider. In theory, cash is the perfect security. The assets traditionally used as security, such as government bills and bonds, exhibit characteristics that make them close substitutes for cash. In practice, cash security is provided in the form of bank deposits and is thereby subject to operational risks related to the transfer of these deposits or the risk that the depository institution defaults.

Although government securities are the main underlying asset used in repo transactions in all major countries, mortgage-backed securities or Pfandbriefe are frequently used. Pfandbriefe are securities issued by certain mortgage banks or state banks in Europe. They differ from other asset backed securities in that they are issued directly by banks, and the assets remain on their balance sheets. Pfandbriefe are issued with recourse.

In addition, more global financial institutions are beginning to accept equity as security for financing arrangements. Transactions such as equity repos can reduce financing costs for dealers while offering cash lenders a higher interest rate if they are willing to take the added risk of equity compared to security with a lower risk profile.

Against the background of these uses of security, some trends in the supply of security are particularly important. On the one hand, securities markets for fixed income instruments as well as for equities continue to grow strongly worldwide, thereby increasing the pool of assets available as collateral.

In contrast, the composition of this expanding pool of securities is changing significantly. The supply of government bonds, often seen as the preferred type of security, is increasing slowly, stagnating or even shrinking in major countries, with the notable exception of Japan. Corporate issues show the highest growth rates, although in many cases, including most continental European bond markets, starting from a very low level.

Additionally, debt securities issued by financial institutions such as asset and mortgage backed securities continue to be on the advance. There seems to be a general tendency towards longer maturities, although it remains an open question whether this reflects a secular trend or the current level of long term interest rates, which in most countries is low by historical standards.

These trends change the overall risk profile of the available pool of securities. With a growing weight of private sector paper, credit risk becomes increasingly important compared to a world where government securities are predominant. Private issues tend to be smaller and more heterogeneous. Additionally, there exist virtually no liquid derivatives markets for private sector fixed income securities. As a result, private issues are basically less liquid and more difficult to value and to hedge than government securities, as indicated by larger bid ask spreads and higher price volatility.

The current upheaval and mayhem in the global financial markets have resulted in an increased demand for secured lending and renewed focus on counterparty credit risk management.

Thus, there is a resultant and greater demand than ever before for an enhanced infrastructure to handle the four dimensions of securities lending business, namely, custody, settlement, borrowing or lending and tri party coupled with demand for process automation and innovation in securities lending.

To minimize any unnecessary settlement, there is an increasing need for increased netting along with increased opportunities in balance sheet netting.

Securities lending business is yearning for an environment where securities particularly bonds could move freely and without friction between settlement systems.

More global players are looking in for an infrastructure that supports fluid upstream and downstream movement of securities.

Market needs cash led standardization in securities lending business and at the same time a trading environment where cash investment is not driven or influenced by settlement considerations.

In the case of securities lending business involving cross border mobilization of securities the requirements are resiliency, cost effectiveness, higher efficiency, harmonized solutions, continuous availability, legally safe and simple to use, intraday and overnight liquidity and integration between cash and securities processing.

Some of the current constraints in securities lending business are fragmentation of collateral liquidity pools, operating hours due to time differences and cut off time, legal and fiscal barriers and proliferation of different legal documentation, different fiscal reporting requirements, lack of complete set of information and lack of harmonization of relevant market practices.

RISK MANAGEMENT:

Some of the major risks associated with securities lending business identified are:

The best way to manage these risks is by establishing a framework covering some important areas such as

– Counterparty evaluation/credit limits

– Legal agreements/master agreements

– Transaction processing and settlement

– Collateralization

– Indemnification

– Managing fails

REGULATORY APPROACHES:

Regulation of securities lending market is still an evolving subject in many jurisdictions.

US market place is highly regulated for many years now. In US, among the regulations that directly relate to securities lending Regulation T is very important. This rule establishes what is known as “the permitted purpose requirement” for borrowing securities – (i.e., that a broker dealer may generally borrow or lend U.S. securities from or to a customer (non broker-dealer) solely “for the purpose of making delivery of the securities in the case of short sales, failure to receive securities required to be delivered, or other similar situations.”).

Rule 15c3-3 under the Securities Exchange Act of 1934, which contains the requirements for how a US broker-dealer documents and collateralizes securities borrows from customers (i.e., the types of acceptable collateral and the amount of collateral that must be provided). 15c3-3 promulgates extensive requirements related to borrowing from customers including the requirement that a broker provides the customer with.

Exchange Act Rule 15c3-1, which has provisions that relate to how a US broker-dealer must adjust the minimum net capital it is required to maintain based on its securities borrowing and lending activities.

There are also other regulations that have an indirect, but nonetheless substantial, impact on securities lending.

CONCLUSION:

According to World Bank, emerging/developing markets enjoyed real GDP growth of around 8% in recent times, with an even greater rate of expansion projected in the coming years. This coupled with rising levels of capital flowing into these countries – particularly Brazil, Russia, India, China, Turkey, Indonesia and Malaysia – means that institutional investors looking to maximize the value of their portfolios should assess the revenue enhancing benefits of lending securities to these markets. Average Reported securities lending earnings remained substantially higher than historical norms throughout the credit crisis and even in the recovery period thereafter, albeit in a small way. The future drivers of this market place are innovation coupled with dynamic risk management practices and ability of the electronic trading environment in enabling internal and external integration. We need to facilitate these drivers.